New ATM Card Withdrawal Limits & Transaction Charges in India

With rising digital transactions, ATM usage continues to remain relevant, especially for cash needs. However, most banks in India impose certain limits on ATM withdrawals, both in terms of the number of free transactions and the amount you can withdraw per day.

Effective from January 1, 2022, customers of most banks can make up to five free ATM withdrawals per month, as per the Reserve Bank of India's updated guidelines. These five ATM transactions cover financial and non-financial services. If a customer exceeds the free monthly limit for cash withdrawals or other transactions, banks will impose a fee.

What is ATM Withdrawal Limit?

The ATM withdrawal limit is the maximum amount of money that can be withdrawn from a savings or current account within a specific time period (per day). This limit varies between banks, typically ranges from a minimum of Rs. 20,000 to higher amounts from the ATM, depending on the type of account.

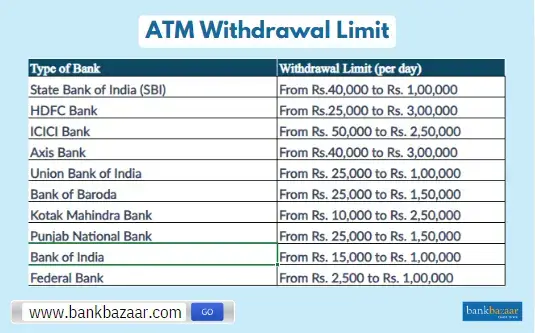

ATM Withdrawal Limits in SBI and Other Banks

Customers are requested to have a look into ATM cash withdrawal limits before making transactions with top leading banks such as SBI, HDFC, ICICI, PNB, Axis and others.

SBI ATM Withdrawal Charges and Transaction Limits

SBI is considered the largest private bank in India. The charges and transaction limits for SBI ATM withdrawals are as follows:

SBI Bank Debit Card Type | Withdrawal Limit (per day) |

SBI One Touch | Rs.15,000 |

SBI Mastercard World Debit Card | Rs. 2,00,000 |

SBI Pragati Platinum Debit Card | Rs.1,00,000 |

SBI Nari Shakti Platinum Debit Card | Rs.1,00,000 |

SBI HPCL-Co-Branded Debit Card | Rs.40,000 |

SBI Global International Debit Card | Rs.40,000 |

SBI My Card International Debit Card | Rs.40,000 |

SBI Gold International Debit Card | Rs.50,000 |

SBI Platinum International Debit Card | Rs.1,00,000 |

- SBI Withdrawal Limit: From Rs.15,000 to Rs.1 lakh.

- SBI Bank Fee for ATM Withdrawals: Up to Rs.10 plus GST (Depending on the number of withdrawals).

- Fee for Non-SBI ATM Withdrawals: Up to Rs.23 plus GST (Depending on the number of withdrawals).

- Foreign ATM Transaction Charges: Minimum of Rs.100 plus GST plus 3.5% of the taxation amount.

- Free Withdrawals at SBI ATM: Starts from 5

Learn more about Sbi Debit Cards

HDFC Bank ATM Withdrawal Charges and Transaction Limits

HDFC is considered the largest private bank in India. It offers many banking services that includes loan services and ATM cash withdrawals. The charges and transaction limits of HDFC bank are mentioned below:

HDFC Bnak Debit Card Type | Withdrawal Limit (per day) |

HDFC Woman’s Advantage | Rs.25,000 |

Moneyback Debit Card, Rupay Platinum Debit Card | Rs.25,000 |

HDFC Titanium Debit Card | Rs.50,000 |

HDFC Titanium Royale Debit Card | Rs.75,000 |

HDFC GIGA Business Debit Card | Rs.2,00,000 |

HDFC Millenia Debit Card | Rs.2,00,000 |

HDFC Infinite Debit Card | Rs.2,00,000 |

HDFC Preferred Platinum Debit Card | Rs.1,00,000 |

HDFC Rupay NRO Debit Card | Rs.1,00,000 |

HDFC Imperia Platinum Debit Cards | Rs.1,00,000 |

- HDFC Withdrawal Limit: From Rs.25,000 and Rs.2 lakh.

- HDFC Bank Fee for ATM Withdrawals: Up to Rs.23 plus taxes

- Fee for Non-HDFC Bank ATM Withdrawals: Up to Rs.23 plus taxes

- Foreign ATM Transaction Charges: Minimum of Rs.125 plus taxes

- Free Withdrawals at HDFC Bank ATM: 5

ICICI Bank ATM Withdrawal Charges and Transaction Limits

ICICI Bank is a multinational bank with it headquarters in Mumbai. It was founded in 1994 and has provided various banking services to its customers ever since. The ATM withdrawal charges and transaction limits of ICICI bank are mentioned below:

ICICI Bank Debit Card Type | Withdrawal Limit (per day) |

ICICI Coral Debit Card | Rs.1,00,000 |

ICICI Rubyx Debit Card | Rs. 1,50,000 |

ICICI Bank Sapphiro Debit Card | Rs. 1,50,000 |

- ICCI Withdrawal Limit: From Rs.1,00,000 to 1,50,000 lakh.

- ICICI Bank Fee for ATM Withdrawals: Nil for up to 5 cash withdrawal in a month; Rs.20 per financial transaction and Rs. 8.50 per non-financial transaction

- Fee for Non-ICICI Bank ATM Withdrawals: Rs.20

- ICICI Bank Withdrawal Limit: Varies from each ICICI Debit Card

- Foreign ATM Transaction Charges: Minimum of Rs.125+3.5 currency conversion charges.

- Free Withdrawals at ICICI ATM: 5

The details mentioned above are for a regular salary account.

Axis Bank Withdrawal Charges and Transaction Limits

Headquartered in Mumbai, Maharashtra Axis Bank is India’s third largest private sector bank. The withdrawal charges and transaction limits of the Bank’s debit card are mentioned below:

Axis Bank Debit Card Type | Withdrawal Limit (per day) |

Axis Bank RuPay Platinum, Visa Classic/Platinum, PMJDY Rupay, Business Classic, Power Salute, NRI Domestic Titanium, Rewards Plus, Mastercard Premium Debit Cards | Rs. 40,000 |

Axis Bank Liberty, Rewards Plus, Secure Plus, Flipkart, Online Rewards Debit Cards | Rs. 50,000 |

Rupay Platinum NRO, Business Platinum Debit Cards | Rs.75,000 |

Axis Bank Delight, Value Plus, Kisan, Republic, Arise,Sampann, Prestige, Display Debit Cards | Rs. 1,00,000 |

Business Supreme, Wealth Debit Cards | Rs.2,00,000 |

Axis Bank Burgundy Debit Card Debit Card | Rs. 3,00,000 |

- Axis Bank Withdrawal Limit: From Rs.40,000 to Rs.3,00,000 lakh.

- Bank Fee for ATM Withdrawals: Up to Rs.23

- Fee for Non-Axis Bank ATM Withdrawals: Up to Rs.23

- Withdrawal Limit: Depends on the Axis bank debit card

- Foreign ATM Transaction Charges: Rs.125

- Free Withdrawals at Axis Bank ATM: 5

Bank of India Withdrawal Charges and Transaction Limits

- BOI Bank Fee for ATM Withdrawals: Up to Rs.23

- Fee for Non-Bank of India ATM Withdrawals: Up to Rs.23

- Withdrawal Limit: Depends on the BOI Debit card

- Foreign ATM Transaction Charges: Rs.125 plus currency conversion charges (2%)

- Free Withdrawals at Bank of India ATM: Up to 5

Punjab National Bank Withdrawal Charges and Transaction Limits

- Bank Fee for ATM Withdrawals: Up to Rs.10 + GST

- Fee for Non-PNB ATM Withdrawals: Up to Rs.23 + GST

- Withdrawal Limit: Up to Rs.25,000

- Foreign ATM Transaction Charges: Rs.150

- Free Withdrawals at PNB ATM: 5

Read more information on Punjab National Bank Debit Card

Canara Bank Daily ATM Withdrawal Limits and Transaction Charges

- Daily ATM cash withdrawal: Rs 75,000 (Classic Debit Card)

- POS Limit : RS. 2 Lakh per day

- NFC(contactless): Rs. 25,000

- Contactless transactions: 5 per day

Tips to Avoid ATM Withdrawal Charges in SBI & Others

There are a few ways in which you can avoid paying ATM charges. These are mentioned below -

- Use your bank's ATM – If you use the ATMs of your bank, you will not be charged any withdrawal fee. If you use some other ATMs then you might be charged a fee for ATM withdrawal.

- Save your free transactions for withdrawal – Keep your free transaction saved for your ATM withdrawal. For things like account statement or amount transfer, you can use your Bank’s net banking facility.

- Use partnered ATMs – Sometimes your bank can partner with other banks. If that’s the case, then you can withdraw from the partnered bank’s ATM.

- Pay bills online – Instead of withdrawing money to pay your bills, you can use the online method to do it. By this you can save your free transactions for other cases.

- Swipe your cards - Swiping your cards in place of using the ATM would cut down on the amount of time you need to withdraw money from ATM.

How to Increase SBI ATM Withdrawal Limit Online

Here is how you can raise the ATM withdrawal limit:

- Contacting your bank and requesting an increase in your ATM withdrawal limits is the simplest method to do so.

- Your account history, the type of accounts you hold, and the duration of the increase you request are some of the factors that could affect the decision of the bank.

- Your bank might be able to make accommodations for you if you require a temporary rise in the withdrawal limit for a particular reason, like a big purchase or a trip.

- You must present a convincing justification to the bank in order for them to approve a permanent rise in your daily ATM withdrawal limit.

- Banks set cash withdrawal limits for security purposes. Therefore, if your withdrawal limit is increased, you should still be careful and keep an eye on your debit card to avoid any unauthorised transactions.

Current Rules Regarding ATM Cash Withdrawal

Certain guidelines are established by the Reserve Bank of India for transactions made via ATMs. The updates are as follows:

- You have to pay Rs.23 for each transaction after your ATM cash withdrawal limit has been reached.

- According to the RBI, the purpose of the transaction charge increase is to make up for the basic cost and interchange fee hikes that financial institutions have to bear.

- Banks typically provide five free ATM transactions in a month.

Summary of SBI ATM Withdrawal Limits and Charges

In 2025, most banks in India allow 5 free ATM withdrawals per month, after which transaction charges are levied. These charges vary based on whether the ATM used is from your own bank or another bank. The withdrawal limits also depend on the type of debit card and the bank’s policy, ranging typically from ₹10,000 to ₹1 lakh per day.

To avoid paying unnecessary ATM fees:

✔️Stick to your bank’s own ATMs.

✔️Track your withdrawal using mobile apps or SMS alerts.

✔️Choose premium debit cards if you withdraw often.

FAQs on New ATM Transaction Charges

- How much money can I withdraw from an ATM in a day?

The daily ATM withdrawal limit differs between banks and is also impacted by the various types of accounts that are available.

- Is there a limit to the number of times money can be withdrawn from an ATM every month?

Usually, banks allow customers to make five withdrawals at no additional charges in a month. Post that, a charge will be levied for each withdrawal at an ATM.

- How much does SBI charge for ATM transactions?

For non-financial transactions over the free limit, customers are charged Rs.10 at SBI ATM and Rs.23at other bank ATMs in addition to the applicable GST rates.

- How many transactions are free in an ATM?

Regardless of the location of the ATM, banks offer a minimum of five free financial transactions every month to customers with savings bank accounts. There will be a limited number of free non-cash withdrawal transactions available.

- Which Bank offers free ATM transactions?

IndusInd Bank and DBS Bank offer unlimited free ATM transactions to its customers.

- How many free transactions can I do with SBI ATM card?

SBI provides five free ATM withdrawals for each region, with the exception of metro cities, where there is a three-withdrawal maximum.

- Does Bank of Baroda provide any free cash withdrawals in a month?

There is no limit to the number of times cash withdrawals can be made at a Bank of Baroda ATM.

- Does Citibank offer free ATM withdrawals?

Yes, no additional fee is levied in case withdrawals are made at a Citibank ATM.

- Why are ATM withdrawal limits set by banks?

ATM withdrawal limits are primarily enforced by banks to monitor cash movements and for security purposes. Additionally, this ensures that banks have enough cash to cover the customer's other liquidity requirements.

Recent RBI Guidelines on ATM Withdrawal Charges 2025

ATM Withdrawal Charges Increased as per New RBI Rules

The Reserve Bank of India (RBI) has implemented new rules for increasing the ATM charges from 1 May 2025. As per the latest guidelines, once the customer crosses their monthly free transaction limit, they have to pay Rs.23 per ATM transaction. Earlier, the charge was Rs.21. The RBI notification states that customers can make up to five free ATM transactions monthly from their own bank, which includes both financial (like withdrawing money) and non-financial (like balance check or mini statement) transactions. For transactions at the ATMs of other banks, customers will get three free transactions per month in metro cities, while those living in non-metro cities can get five free transactions per month. These charges will also apply to Cash Recycler Machines (CRM) when withdrawing money or checking the balance. However, there will be no charge for depositing money using a CRM.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.