What is CIBIL Dispute?

CIBIL Dispute is the process of identifying and fixing errors in your credit report or The process of finding and resolving inaccuracies in your credit report is called CIBIL Dispute.

Table of Contents

- Types of Disputes that May Arise with CIBIL

- How Can you Raise a Dispute on the CIBIL Website?

- How Can you Raise a CIBIL Dispute Offline?

- How to Resolve CIBIL Disputes?

- Process of Resolution of CIBIL Dispute

- How to Register a Complaint on CIBIL’s Consumer Dispute Resolution Portal?

- What are Credit Reports?

- Issues with CIBIL Credit Score

- Documents Required for Visiting the CIBIL Office

- Company Dispute Resolution

- CIBIL Customer Care Details

- How to Dispute Errors in Credit Report?

The primary credit bureau in the country, Credit Information Bureau India Limited, or CIBIL, is responsible for gathering and assessing consumer credit information. This entails obtaining client credit data and applying several factors to determine each customer's credit score. It is customary for businesses as well as individual consumers to assign credit scores and record credit histories.

A credit bureau assigns a three-digit number known as a CIBIL score. The figure establishes your creditworthiness in terms of money. Before granting you a loan, banks and lenders consider this, which is based on your credit history. When information is gathered from various lenders, TransUnion CIBIL verifies its authenticity before printing it on credit reports. You can always make the necessary corrections if there are any inconsistencies in your CIBIL report or score, including information about your identity, outstanding balance, date of birth, bank, or loan account.

Types of Disputes that May Arise with CIBIL

Various types of disputes may arise in an individual's or a company's credit report. Knowing the category of dispute makes the process of resolution easier. Here are some of the most prominent dispute types that customers can have with respect to their CIBIL report.

Company disputes

- Company or Account Details:

Various details pertaining to company like name, address etc. can be disputed. Company PAN and account details like credit type, sanction amount are certain examples of account details.

- Ownership

Ownership disputes may arise if the company account mentioned is not actually on your name.

- Duplicate Account

In your credit report, if the same account is being repeated over and over then you might wish you raise a dispute and get it rectified.

- Fields which can be incorrect

Here are the company details which can be disputed-

Company Name

Legal Constitution

City

State

PIN Code

Company's Registered Address

Company's Branch Address

Telephone Numbers

PAN (Company)

Promoter/ Director/ Proprietor/ Partner Name

Relationship

- Personal Details

This includes name of customer, address details etc. For example, Mohit Kapoor may be misspelt as Mohit Kapur and hence might need rectification.

- Duplicate Account

Individual disputes

Your account may be present twice and hence a duplicate dispute may arise which can be rectified by raising a dispute request with CIBIL.

NOTE:

Some details for which a dispute cannot be raised are listed below.

Control Number

Member Name (Unless it is an Ownership Dispute)

Account Number (Unless it is an Ownership Dispute)

Date Reported

Enquiry Datev

How Can you Raise a Dispute on the CIBIL Website?

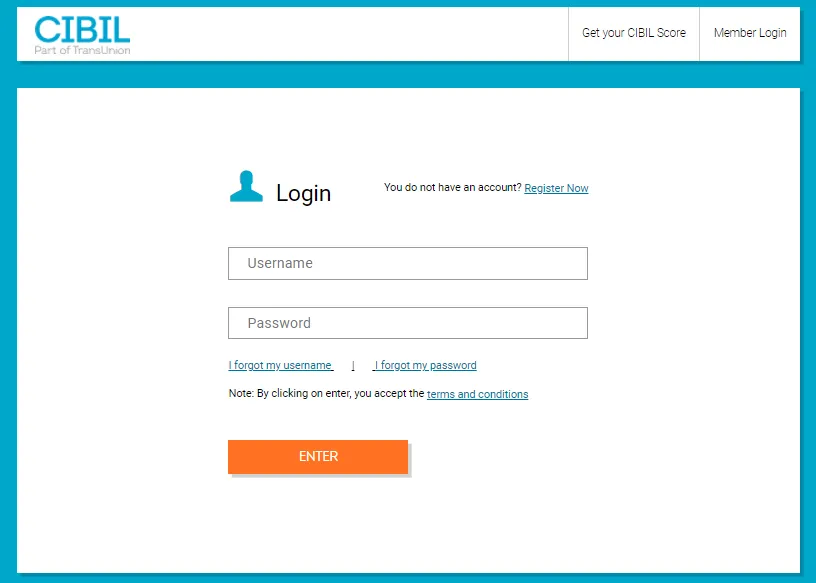

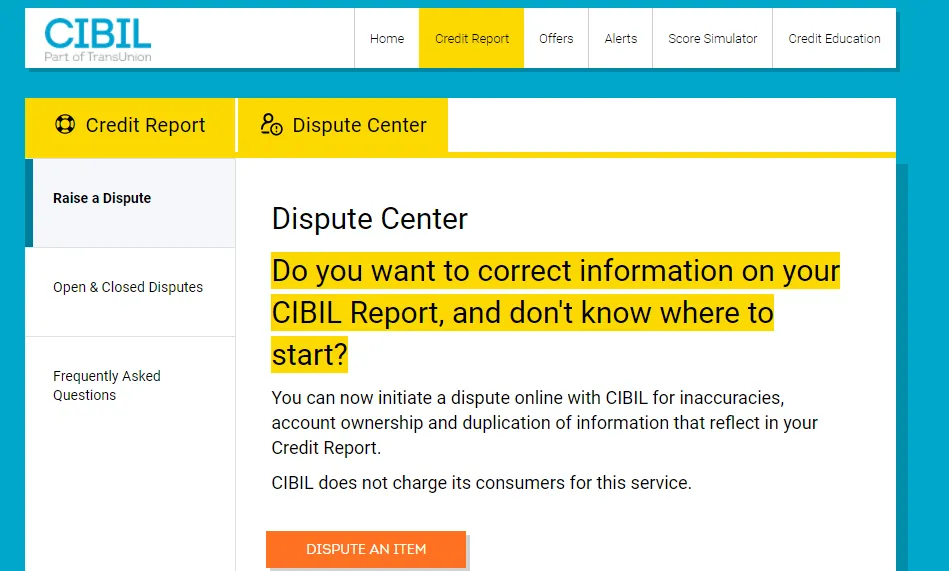

Step 1: Go to the website and click on 'myCIBIL' and log into CIBIL

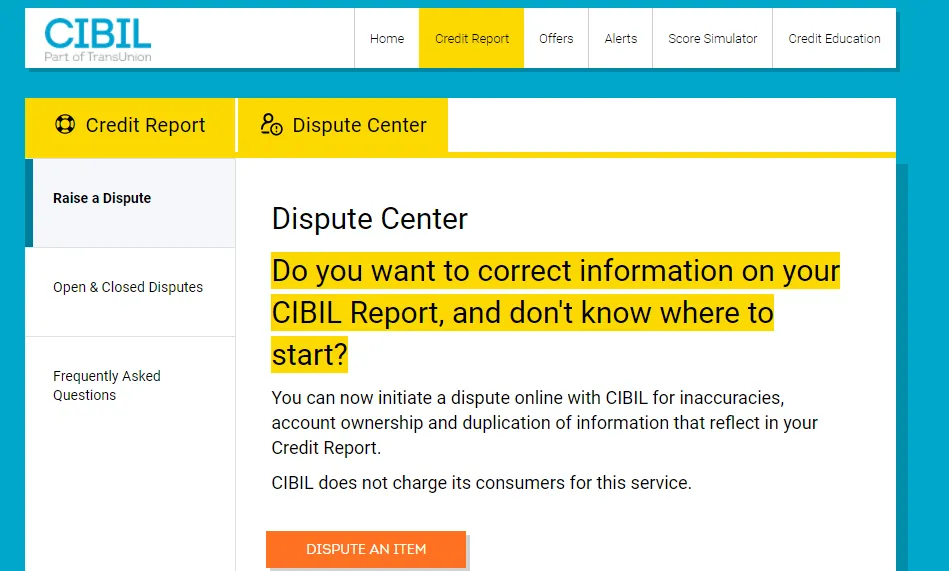

Step 2: After you log in, click on 'Credit Reports' and select 'Dispute Centre'. Select 'Dispute an Item'.

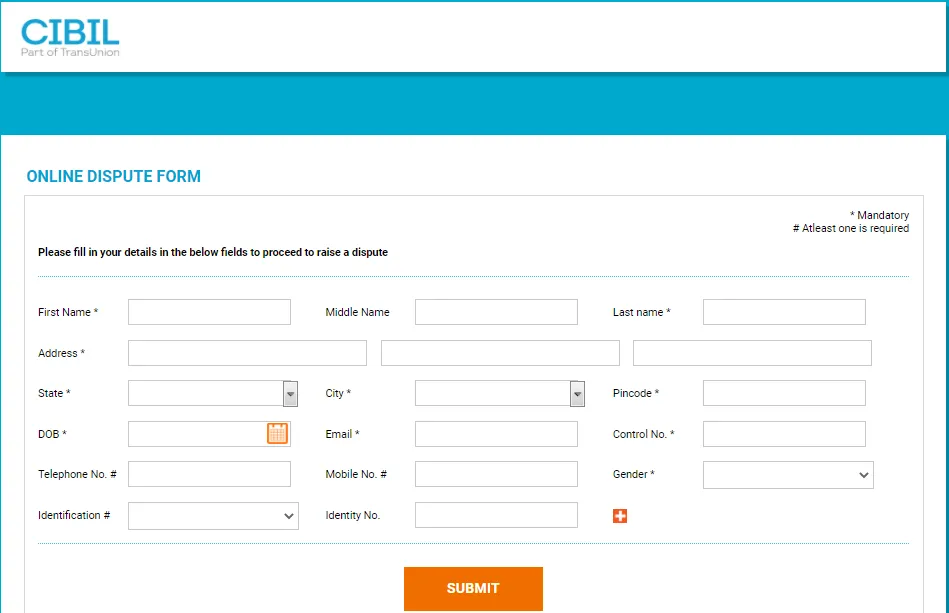

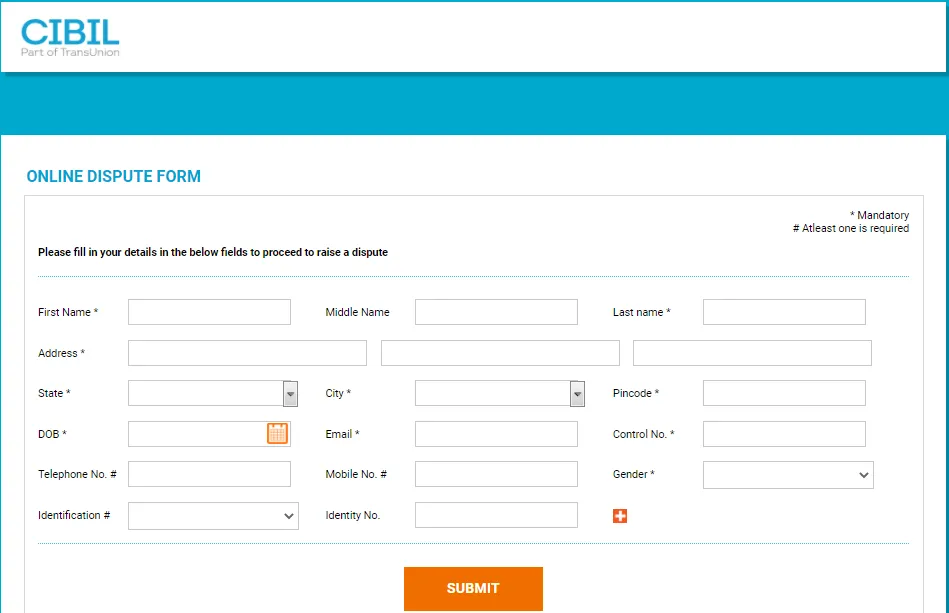

Step 3: Fill in the dispute form with your contact details and click on 'Submit'

Step 4: Choose the section of your CIBIL Report for which you want to raise the dispute.

If the dispute is about an error in ownership details or duplication of information, you can select the type from the menu.

If the dispute is about inaccuracies in data, you can enter details in a field and click 'Submit'.

How Can you Raise a CIBIL Dispute Offline?

If you want to raise a CIBIL dispute offline, you can always write to TranUnion CIBIL:

TransUnion CIBIL Limited,

One Indiabulls Centre, Tower 2A, 19th Floor,

Senapati Bapat Marg, Elphinstone Road,

Mumbai - 400 013

How to Resolve CIBIL Disputes?

Companies and individuals must complete a special online dispute form in order to have their CIBIL report corrected. This is the initial move in settling your conflict with CIBIL. One piece of information that you must include on the dispute form is the control number that appears on your credit report. Each time your CIBIL report is generated, this control number, a nine-digit unique number, is reissued. You will receive a dispute ID once the dispute form has been properly completed. Your dispute request and any subsequent correspondence on it can be tracked with this ID.

If CIBIL is able to resolve the issue, making the necessary modifications is not difficult. But, CIBIL tries to get in touch with your credit provider and asks dispute resolution if it does not have enough information to fall back on and make adjustments. CIBIL updates your information in its database and on your CIBIL report as soon as the loan provider verifies that there is a mistake in the report. The resolution of any dispute brought up with CIBIL could take up to 30 days. You will receive an SMS notifying you when your report has been corrected. You will need to request your CIBIL report one more in order to confirm the modification and determine whether it has been updated.

The most crucial thing to remember in this situation is that CIBIL is not a body that modifies or alters your data. It is merely an organisation tasked with gathering and confirming data obtained from different lending and credit groups.

A customer's credit report, often known as their CIBIL report, is a crucial document. A customer's credit report is the only factor used to determine their credit worthiness. As soon as a discrepancy in the report is discovered, it should be fixed. When determining a customer's eligibility for credit, banks and other lending institutions consult their credit report first.

Process of Resolution of CIBIL Dispute

- Step 1: CIBIL will verify your disputed information and will convey these details to the lender depending on the type of dispute.

- Step 2: If the lender accepts this dispute, the corrections will be made by CIBIL and the updated details will reflect on the next credit report.

- Step 3: After the dispute has been resolved, the 'Under Dispute' tag will be removed from the field.

It will take around 30 days for CIBIL to resolve the dispute.

How to Register a Complaint on CIBIL’s Consumer Dispute Resolution Portal?

Here are the steps to register a complaint on CIBIL’s Consumer Dispute Resolution portal:

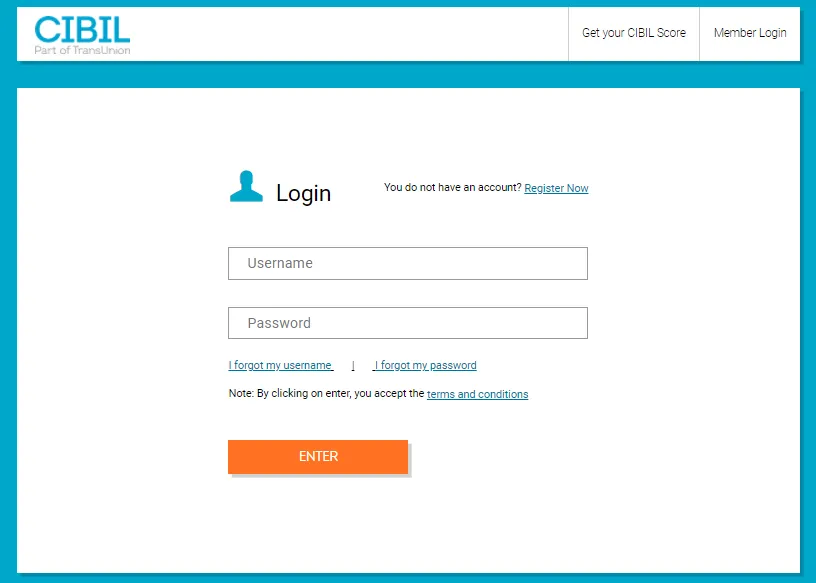

- Log into CIBIL Dashboard using your credential

- To check the updated version of CIBIL report by refreshing your report

- To register your complaint, fill in the dispute request form

- If required, you need to fill in multiple forms

- Your complaint will be raised by the TransUnion CIBIL by reaching out to the lenders

- The required changes will be reflected on the CIBIL report within 30 days of raising the complaint.

What are Credit Reports?

Credit history, including loan and credit card payments, is monitored by the Credit Information Bureau (India) Limited (CIBIL). Each month, CIBIL produces Credit Information Reports (CIR) and credit ratings based on data from different banks and other financial organisations. In order to assess a person's capacity to repay loans, banks typically look at their credit history. If your credit score is high, the bank is more likely to approve your loan. CIBIL typically yields a three-digit score. Consumers with credit scores ranging from 300 to 900 are eligible.

Issues with CIBIL Credit Score

The various issues with CIBIL credit score are mentioned below -

- Error in CIBIL credit report -Small errors such as misreading your address or name could show up in your CIBIL report. Though it can seem like a minor error, it can have negative consequences. The third category of damage that could occur is from a mistaken identity, when you could find out about someone else's loan details in your credit report or an outstanding balance on a loan for which you haven't applied. These minor errors will have a substantial negative impact on your CIBIL score and could lead to the rejection of your application. To start solving the problem, get a copy of your CIBIL credit report from CIBIL. After gaining access to the reports, review the errors and submit a dispute through the CIBIL website's given dispute resolution form. One needs to mention their name, date of birth, place of residence, and control number when submitting a dispute resolution.

Getting a copy of your CIBIL credit report from CIBIL is the first step towards the solution. Once you get access to the reports, examine the mistakes and file a dispute using the provided dispute resolution form on the CIBIL website. When filing a dispute resolution, one must include their name, residence, date of birth, and control number. - Bad credit history - Your prospects of obtaining a loan, credit card, or any other type of credit will be severely hampered by a bad credit score or credit report. You can avoid this situation by paying your credit card bills on time, avoid making minimum payments, avoid getting excessive debt, and inform your bank if you are not able to make the payments.

- Days Past Due (DPD) - Days Past Due indicates the number of days a payment on that account is past due for that particular month. For the lender, any value other than '000' is considered bad. If your DPD is not "000," you have not fulfilled your financial obligations, which could have a negative impact on your credit history. The best way to avoid bad DPD is to respect your financial obligations without any problems by making your payments on time and avoiding taking on excessive debt.

Documents Required for Visiting the CIBIL Office

The following is the list of documents required by the consumers for visiting the CIBIL Office:

- Individual customers:

- Driving License

- PAN

- Voter ID

- Passport

Corporate Entities (Private and Public Limited Companies):

- PAN of the corporate entity attested by the CS, or

- Copy of Driving License, PAN, or Passport of authorized signatory submitting request for CIBIL Company Credit Report (CCR).

Partnership Firms:

- The trustee’s PAN card copy, who has made the request for CIBIL CCR, or

- Copy of PAN of the Trust

HUF (Hindu Undivided Family):

- Copy of PAN card of the karta, or

- Copy of PAN of HUF

Registered Society:

- Copy of PAN card of the karta, or

- Copy of PAN of HUF

Entities created by Statues (excluding regulators):

- Copy of Driving License, PAN, or Passport of authorized signatory submitting request for CCR, or

- If available, copy of PAN of the entity

Government Bodies or Public Sector Units:

- Copy of Driving License, PAN, or Passport of authorized signatory submitting request for CCR, or

- PAN Copy of the Government entity (if available)

Unincorporated Association or a body of individuals (AOP). SHG's would form part of this category:

- List of authorized signatories with specimen signatures

- Authorized signator’s copy of PAN

Trust

- PAN of Trust, or

- PAN, Driving License, Passport of Trustee submitting request for CCR

Proprietorship Firms:

- Copy of the proprietor’s PAN

Company Dispute Resolution

- Step 1: Click on 'Company Dispute Resolution Portal' on the CIBIL website and select 'Raise an Online Dispute'.

- Step 2: Enter all details with the reason for raising a dispute.

- Step 3: Enter the captcha code and select 'Submit'.

CIBIL Customer Care Details

Here are the details of CIBIL customer care details:

- CIBIL Customer Care Number: +91-22-6140 4300 (Mon to Fri: 10 A.M. to 6 P.M.)

- Official Portal: https://www.cibil.com/consumer-dispute-resolution

- FAX: +91-22-6638 4666

- Email: info@cibil.com

- CIBIL Corporate Office Address:

TransUnion CIBIL Limited (Formerly: Credit Information Bureau (India) Limited) One World Centre, Tower 2A, 19th Floor, Senapati Bapat Marg,

Elphinstone Road, Mumbai – 400013

How to Dispute Errors in Credit Report?

A detailed process on how you can dispute errors in credit report is mentioned below -

- Fill in the form - You can submit mistakes to the credit bureau online. Proceed to the dispute resolution section and fill out the form to fix the mistake. It is imperative that the disputed information be submitted using the nine-digit number that appears on your credit report.

- Process - Following the submission of your online complaint form, the credit bureau will contact the bank to confirm the dispute. It should be remembered that credit bureaus are unable to independently alter credit reports.

- Dispute Resolving Period - Approximately 30 days are needed to settle a dispute on average. The law mandates that banks address a disagreement in writing within 45 days of the issue being brought up. You will receive an email informing you of the outcome as soon as it has been handled.

Disclaimer

Display of any trademarks, tradenames, logos and other subject matters of intellectual property belong to their respective intellectual property owners. Display of such IP along with the related product information does not imply BankBazaar's partnership with the owner of the Intellectual Property or issuer/manufacturer of such products.

How Can you Raise a Dispute on the CIBIL Website?

If you want to raise a CIBIL dispute offline, you can always write to TranUnion CIBIL:

TransUnion CIBIL Limited,

One Indiabulls Centre, Tower 2A, 19th Floor,

Senapati Bapat Marg, Elphinstone Road,

Mumbai - 400 013

Step 1

Go to the website and click on 'myCIBIL' and log into CIBIL

Step 2

After you log in, click on 'Credit Reports' and select 'Dispute Centre'. Select 'Dispute an Item'.

Step 3

Fill in the dispute form with your contact details and click on 'Submit'

FAQs on CIBIL disputes in India

- What are the various situations in which I can raise a CIBIL dispute?

A CIBIL dispute can be raised in the following events-Inaccurate balance overdue,Inaccurate personal details,Ownership issues

- Why does CIBIL not confirm information with customers before drawing the CIBIL report?

CIBIL looks up to various credit institutions for furnishing of accurate information. Customer involvement in this case is neither required nor advisable.

- What should I do when I see an error in my CIBIL report?

Any error in your CIBIL report should immediately be informed and gotten rectified. For this the first step would be to fill out the online dispute form at the CIBIL official website.

- Once the lending institute furnishes the correct information, how much time does CIBIL take to reflect the correct data?

CIBIL takes around 7 days to update your records once the correct data is furnished by your bank.

- How do I know that my dispute with CIBIL has been resolved?

CIBIL sends across an email as well as SMS for letting you know that your dispute has been resolved.

- What do I do if I am not satisfied with the dispute resolution?

In case, you are dissatisfied with the dispute resolution, you will need to raise a new request or contact CIBIL directly. CIBIL updates information only when it is furnished by the credit institutions.

- Is there any way I can personally visit the CIBIL office to raise a dispute?

No. CIBIL disputes can be raised only via CIBIL's website and application form for the same can also be filled online. Tracking of the dispute request happens via email as well as SMS.

CIBIL Score Requirements for Loans

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.