Credit Worthiness

What is Creditworthiness?

Creditworthiness is how worthy you are of using credit. If a bank or a Non-Banking Financial Company (NBFC) finds that the borrower will respect all debit obligations, they are considered being creditworthy.

However, in some cases it could be challenging for a borrower to evaluate their creditworthiness which could lead to conflict of interest with the lender. Thus, credit bureaus evaluate the creditworthiness of the individual and risk associated of repayment in order to help the banks or NBFCs to determine whether to sanction the loan to them.

Creditworthiness is basically a financial report card which tells you how you have managed your loans and credit card debts. Through the help of this credit report, lenders can also find your repayment history. On the basis of your credit worthiness, a lender will decide whether or not to approve your loan application. Hence, it is important to improve your creditworthiness and you maintain that by making timely payment without any default.

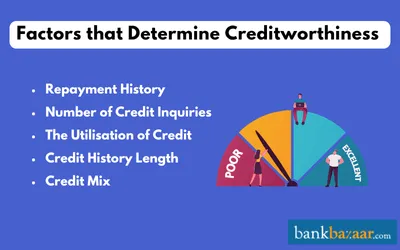

Factors that Determine Creditworthiness

Your creditworthiness will be determined by various factors. Given below are the key factors:

- Repayment History: Banks or other lending institutions determine the creditworthiness of a borrower to a great extent by their repayment history of loans and credit card bills. If the borrower fails to make a credit card payment, it will impact the credit score. Apart from this, if you repay your credit card dues or loan after the due date and if the number of unpaid bills increases, it will affect your credit score. A credit score is contributed by 30 percent of a borrower’s credit history. Thus, it is extremely important to repay Equated Monthly Instalments (EMIs) and credit card bills on time.

- Number of Credit Inquiries: As we have already discussed, lending institutions make sure to check the borrower’s credit report before sanctioning a loan in order to determine if there is a new credit enquiry. This helps in assessing whether the borrower has the ability to repay the loans. If a borrower applies for multiple credit cards or loans on a regular basis, this shows that they may not be able to meet certain repayment conditions. If a borrower makes multiple credit inquiries, their credit score will be reduced by 20 percent.

- The Utilisation of Credit: The third most important factor which determines the creditworthiness of a borrower is their credit utilisation. This contributes 25 percent of your credit score. In addition, in case a borrower has poor spending habit, it can result into higher credit utilisation ratio which will automatically decrease the credit score.

- Credit History Length: If you have a stable and a long credit history, it will provide a positive impact on your credit score. The lenders will approve loans to those who have a consistent repayment history. Hence, one should not close old credit cards even if they are not using and keep the cards active in order to maintain a good credit score.

- Credit Mix: The lenders will also ensure to check the credit mix of secured as well as unsecured loans before approving a loan.

Importance of Creditworthiness

Now, let us look at the importance of creditworthiness:

- In case you do not have any plans to apply for a new credit card or a loan in future, it is important to maintain and improve your credit score.

- Other than financial institutions, a wide range of sectors like cell phone carriers and cable providers will affect your creditworthiness.

- If you maintain a good credit score consistently, you can avail any kind of financial as well as non-financial services in future, without any restrictions.

How do Credit Scores Work?

Although credit score may not determine the creditworthiness of a borrower, it can play a significant role in their financial life. In fact, creditworthiness plays a primary role in the decision of a lender. For instance, borrowers who have credit score of less than 640 are mainly considered risky. In such cases lenders charge high interest on loans offered. This helps to compensate for having the additional risk. Not only this but they also have to repay the debit in a shorter tenure.

On the other hand, a credit score of 700 or more is considered strong and lenders provide them loans at a relatively lower interest rate. Credit scores above 800 are considered excellent. Now, let us have a look at the various credit score range:

- Poor: 300 to 579

- Fair: 580 to 669

- Good: 670 to 739

- Very Good: 740 to 799

- Excellent: 800 to 850

Whether it is a personal loan request or a credit card application, lending institutions check the credit score of the borrowers without any fail to assess their eligibility. A higher credit score shows a lower risk premium for the banks or NBFCs.

Disclaimer

Display of any trademarks, tradenames, logos and other subject matters of intellectual property belong to their respective intellectual property owners. Display of such IP along with the related product information does not imply BankBazaar's partnership with the owner of the Intellectual Property or issuer/manufacturer of such products.

FAQs on Creditworthiness

- What is the meaning of creditworthiness?

Creditworthiness is similar to a credit report card in that it indicates to lenders a borrower’s likelihood of repaying a loan or credit card debt.

- What are the examples of creditworthiness?

Some of the examples of creditworthiness are good repayment history, lower credit utilisation ratio, long credit history length, etc.

- How is creditworthiness determined in India?

The key factors which determine the creditworthiness in India are repayment history, credit utilisation, credit mix, credit enquiries, and credit history length.

- How do you calculate credit worthiness?

To calculate creditworthiness, the lenders consider amount you owe, payment history, recent credit activity, etc.

- Why is creditworthiness important?

You won't have any limitations in the future when it comes to obtaining any type of financial or non-financial services as long as you continuously keep a high credit score.

- What is the creditworthiness rating?

A credit score is usually used to determine creditworthiness. Your credit history and financial behaviour are represented numerically by your credit score. Higher scores denote better creditworthiness, with the most typical credit score range being between 300 and 850.

CIBIL Score Requirements for Loans

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.